Markets

Cloudy Fiscal Future Mars Growth Capital Formation

|

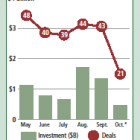

Eleven months into the year, it’s clear that 2012 is shaping up as one of the worst capital raising environment for small growth companies in recent memory. While deal making in the first half of 2012 suggested that activity would at least match 2011, the pace of transactions have trailed off since July 1 amid uncertainty surrounding the elections and future tax and spending policies in Washington D.C.

So far this year, growth companies and investors have raised $11.8 billion in 379 growth equity private placements (GEPPs), according to PlacementTracker, a division of Sagient Research. By comparison, there were 417 transactions completed that generated $12.3 billion in financing in the first 11 months of 2011, and 538 deals valued at $13.8 billion over the same 2010 period. At the halfway mark of 2012, issuers had raised $6.6 billion in 216 deals. The growth equity private placement dataset comprised emerging growth companies with market capitalizations from $10 million to $1 billion with share prices over $1.