Markets

Growth Equity Market in Transition as Autumn Deal Season Begins

|

The emerging growth capital market rounds the corner into the fall deal season with overall robust deal flow masking major shifts in how and to whom capital is allocated. Increasing reliance on registered offerings of common stock priced at market is remaking the old PIPE market of “desperation financing” into a deep and efficient marketplace for issuers seeking strategic capital to fuel targeted corporate development programs.

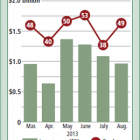

At the close of August, the equity private placement (EPP) market had raised $29.15 billion in capital in registered and unregistered equity and equity-linked offerings in 2013. That’s a 5% increase over the same period in 2012. That respectable aggregate market growth overlays significant shifts in capital allocation by growth capital investors away from unregistered to registered offerings, led by the growth of at-the-market (ATM) and, surprisingly, old-fashioned rights offerings. Were it not for a 300% increase in ATM dollars raised, and 400% increase in rights offerings in the first eight months of the year compared to a year ago, the 2013 EPP market would be trailing 2012 activity by almost $10 billion. ATM offerings increased from 80 programs raising $765.8 million a year ago to 108 programs that have raised $2.38 million so far this year, accounting for 8% of all capital raised in the EPP and PIPE markets this year.