Markets

Registered EPPs Move Down Market

|

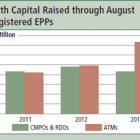

Registered equity private placements (EPPs) are becoming available to ever-smaller emerging growth companies, as a robust small cap market and increasing competition among placement agents for deal flow broadens the potential pool of eligible issuers. Registered EPPs, including registered direct offerings (RDOs), confidentially marketed public offerings (CMPOs) and at-the-market offerings (ATMs), are now being executed by the smallest of public companies, further diminishing the need for these companies to rely on expensive and highly dilutive PIPEs to fund their corporate development. More than $4.2 billion in growth capital has been raised in 200 registered EPPs so far this year through Nov. 1 by emerging growth companies with market caps from $10 million to $1 billion, according to data by PlacementTracker, the EPP tracking service of Sagient Research Systems. That’s a better than 10% increase in total deals closed at this time last year, when 182 offerings had been completed. Total capital raised or committed is also up compared to the year ago period, with $6.1 billion closed or committed compared to $5.9 billion a year ago.