Legal

SEC Accuses Yorkville of Earning Millions From Inflated Fund Values

|

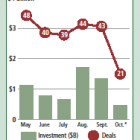

Two New Jersey-based hedge fund managers who ran a billion dollar PIPE fund were sued for investor fraud by the Securities and Exchange Commission today. Mark Angelo, 40, and his CFO Edward Schinik, 46, of Yorkville Advisers were pioneers in the PIPE investing space funding small and micro cap companies through convertible debt with warrants to buy stock at a discount. From 2001 through 2008 their funds never showed a negative performance period. But at the end of 2010 investors were suddenly surprised when Yorkville told them the funds' value had dropped 33 percent. The SEC’s complaint alleges Yorkville began inflating the value of its investments during the start of the 2008 financial crisis to earn at least $10 million in fees and entice an additional $280 million from investors. Angelo, Yorkville’s founder, earned a 20 percent fee off the funds’ performance.