Deals

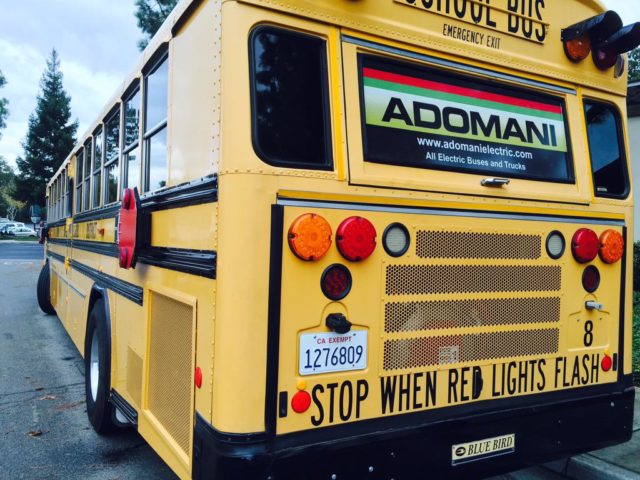

Adomani Raises $10M in Five Days with Broker-led Sales Program

|

Adomani, a Southern California company developing energy efficiency technologies for the automotive industry that is backed by UPC Venture Funds, has met its minimum goal of raising $10.6 million five days